Islamic Banking and Halalonomics

One will find it hard to distinguish between Islamic Banking and Halalonomics. Both are entrenched in Islamic values. Halal products are flooding the market with backing of the Islamic economy. Sharia forbids riba (charging interest on a sum of money), as such the Islamic Banking system has evolved to be Sharia compliant. For example, Malaysia is a world leader in Islamic Banking and Finance and the Halal industry. In 1983, the first Islamic Bank (the Bank Islam Malaysia Berhad) was established in Malaysia through the introduction of the Islamic Banking Act. Since the functioning of Islamic Banks is governed by religious laws, they are not recognised by a number of non-Islamic nations, including India. In 2006, the Halal Industry Development Corporation was established in Malaysia (though halal products have been in use even prior to this) to promote the Halal industry. In 2013, Kuala Lumpur hosted the World Halal Research and World Halal Forum Summit, with a focus on ‘Halal Economy’. This summit pledged to bolster acceptance of Halal products worldwide through greater cooperation between the Halal industry and the Islamic banking and Finance sectors. Also, to promote investments in the Halal industry, index series like the SAMI (Socially Acceptable Market Investments) Halal Food Indexes (a stock market index listing Sharia compliant companies) are gaining popularity. It is worth noting that these efforts have gathered tremendous support as well as momentum over the years.

The religious foundations of Halalonomics

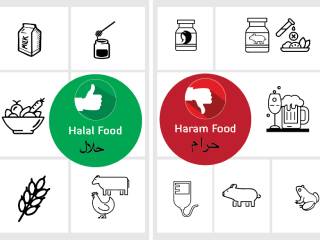

While the Quran does not have any instructions or guidance on Halal Economics, it does allude to ‘what is halal’ and ‘what is haram’. 56 Ayats in the Quran mention the word Halal while 21 find some mention in relation to food. The word Halal is also mentioned in the Hadiths (considered as the direct and indirect teachings of prophet Muhammad). These include the sin incurred on consuming food that is haram and the punishment that one has to undergo for it. These form the basis for Halal economy as well as the guidance by Islamic scholars to Muslims world over on this subject.

Halal – gaining a stronghold over world economy

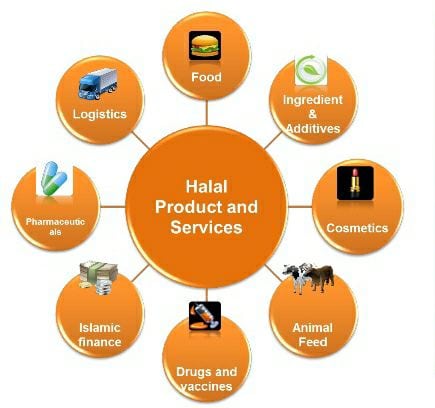

The Halal Industry governs all aspects from the farm to the consumer, which includes the production and distribution lines. As the halal economy taking shape, a greater emphasis was placed on growing the Islamic economic sector by utilising this Halal Economy. In the words of Rafe Haneef, CEO of HSBC Amanah Malaysia – “If we are going to move towards a Halal economy, we have to take a holistic approach; the whole cycle, the whole chain has to be Halal from the production to the financing.” What this translates into is utilising the profits from the halal products to fund more production and distribution of other halal products, as well as providing financial assistance to the halal industry. All this happens exclusively through the Islamic Banking and Finance system. With this, a complete control is gained over the entire chain from production to consumer, world over ! There is sufficient evidence that this works, one among them being the astronomical increase in the market share of Islamic banking assets from 6.9% in 2000 to 22% in 2011 in Malaysia alone. This growth has placed the Halal Industry at the forefront of the fastest growing industries. Clearly, the Halal Industry (built on the backbone of Islamic principles) and the Islamic Banking and Financial services (built on the halal industry) are now going from strength to strength.

Casting aside age old laws in favour of an all encompassing Halal economy !

The idea of halal economy has grown from its somewhat humble beginnings pertaining to only meat. This has pushed the need to tweak rules to suit different needs. So depending on the prevalent conditions, something that may have been considered as haram a few years ago has become halal now.

A parallel can be drawn from another Islamic practice – the call to prayer or Azaan. Azaan is considered a sacred call to the faithful and the use of loudspeakers to sound the azaan was considered as haram. But with the realisation that the loudspeaker can be a powerful tool in the spread of Islam, not only was it accepted, it became indispensable. In fact, every mosque has a set of loudspeakers which threaten social peace every single day. Similarly the push to strengthen the Islamic economy has facilitated the tweaking of old laws to widen the scope of the halal industry. A prime example would be the cosmetics industry. A few years ago usage of any cosmetic product was considered haram; but now even halal cosmetics are available.

The ever widening scope of the halal industry will be evident with the following examples –

a. Meat to Vegetarian products : Even the famed all vegetarian Haldiram’s namkeens (snacks) are now halal certified. Dry fruits, sweets, chocolates are also included.

b. Foodstuff to Cosmetics : Grains, oil, soaps, shampoos, toothpaste, kajal (eye liners), nail polish, lipstick and other cosmetics are now under the ambit of ‘Halal’ certification.

c. Medicines : Unani, Ayurvedic medicines, honey are now halal certified.

d. Multinational food chains : McDonald’s burgers, Domino’s pizza, food available in almost all airports is now Halal certified.

e. Halal apartment complexes : Kochi (Kerala) is now home to the country’s first halal certified apartment complex built as per sharia regulations. The complex has separate swimming pools for men and women, separate prayer halls, washrooms that face away from Mecca, clocks that alert you to namaz timings, facility to broadcast the namaz into every house among other ‘modern’ amenities.

f. Halal hospitals : Global Health City (Chennai, Tamil Nadu) is a halal certified hospital. They claim to meet international standards of hygiene and dietary regulations as per the tenets of Islam. This halal certification helps the hospital cater to the demands of patients from over 50 Islamic countries and gives hospital tourism a boost.

g. Halal dating websites : There are numerous websites for singles to meet up and befriend each other. Now there are halal certified dating websites that do this in a sharia compliant way, ‘Mingle’ being one among them.

Halal certification fees in Dar al-harb nations

The halal economy tries to impose a wholly Islamic system in the production-to-consumer chain, but it is not easy to compete with the existing giants in the industry. For example it would take an inordinate amount of time and energy to produce and market halal products that would meet or surpass the existing products by leading brands like McDonald’s, Domino’s, Taj Caterers, Haldiram’s, Bikano, Vadilal Ice creams, Kelloggs, Daawat Basmati, Fortune Oil, Amrutanjan, VICCO etc. It is also not possible for these companies to employ only Muslim employees when operating in non Islamic countries (Da al-harb). So they have been given some special ‘concessions’. They are ‘allowed’ to pay a hefty fee to obtain a (renewable) halal certification. This fee is used to strengthen the Islamic finance system. Earlier, non Muslim subjects under Islamic rule were forced to pay a ‘protective’ Jizya tax (to be exempt from conversion). Similarly companies today are being ‘asked’ to pay up large sums of money as ‘halal certification fees’ if they want their products to be certified for use by Muslims.

Boycott Halal Products Gallery

Boycott Halal Products Gallery What is Halal ?

What is Halal ? Hindu majority compelled to consume halal meat by government run institutions !

Hindu majority compelled to consume halal meat by government run institutions ! Dictatorship of the small minorities !

Dictatorship of the small minorities ! Why do we need private Halal certification body when India has a food safety authority ?

Why do we need private Halal certification body when India has a food safety authority ?